If you do want to try and catch a flash crash then dropping in some very small bids/offers far out in the market is the way to do it. In most cases where we lose money on a flash event, it’s a case of ‘shit happens’ but when you know there’s increased risk and you do nothing about it, you only have yourself to blame if you get caught. It’s all about managing risk and I’d rather be out than having to face a possible mess and loss of money because I was too carefree trying to grab a few pips. Unless I’m in something long-term that can ride out big volatile moves, I often clear the decks of all trades into periods like this. Easter and the Japanese holiday is one such period. My overall advice would be to not fuss about them too much but make sure your trades are protected if we are heading towards periods where liquidity might be an issue. Whatever the big boys decide to do, we retailers will always be stuck in the middle and thus out on a limb, and that’s not where we want to be. The obvious flip side to that is that it also reduces liquidity further and leaves potential air pockets, which then aid any crash like moves. They might stack bids/offers lower/higher right outside of current ranges to catch a crash move (thus providing supporting liquidity), or they may close positions for the period in question. But, even that talk is potentially self-defeating because if traders are expecting it, they protect against it. We can’t live our trading lives worrying about flash crashes, the same as we can’t worry about getting struck by lightening but we can be aware when situations might lead to a slim possibility of something happening, like the chatter of something happening over Easter or Japan’s Golden week. There can be lots of quick knock-on effects. The market can run about chasing trades and trying to re-positions and chase back any losses. Little things can then bring big moves because everyone is a little bit shaken and panicky. If you don’t use stops, you’re going to get sunk if your broker closes you out on a margin breach (hence why you should always have a disaster stop in place on any trade).īut even if the moves start reversing, for me there’s always a fear of “What if it hasn’t finished?” in those first few minutes because what happens is that the market gets very nervous and jumpy about its own shadow. If you’re already holding trades, you’re either going to get very lucky and make your profit very quickly, or you’re going to get stopped.

No mere retail trader should be trying to jump in to those waters. Spreads will blow out, platforms will freeze and it becomes a big mess. Do you chase it, do you fade it? Given how volatile they can be, we would be trying to trade something moving in 50-100 pip increments. Usually by the time we’ve found out what’s happened, the move is all over or at least starting to reverse.

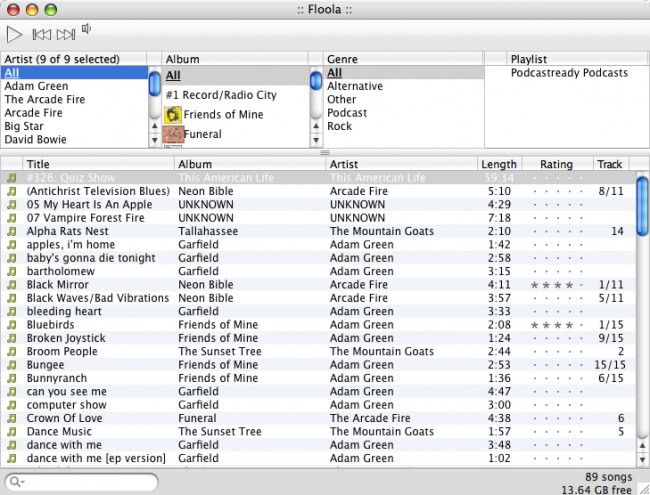

Floola crashes after 20gb transfer how to#

For those first moments no one has the foggiest idea, and more importantly, no one knows how to react. Has there been news? Has a CB raised/cut rates or intervened in an emergency? Has an institution collapsed? Has war broken out? Is it a fat finger? etc etc.

Here’s how to trade and protect yourself from flash crashes

0 kommentar(er)

0 kommentar(er)